Trust - The New Brand

Return on Trust: The New Business Performance Indicator

To

succeed in today’s digital age, companies must think beyond dollars, cents and

convenience, and focus on data ethics. As malfeasance, blunders and mishandling

of consumers’ personal information reaches epic proportions, trust is the new

battlefield for companies to seize the digital high ground, our latest research

reveals.

We

are in the midst of a trust revolution. By our count, 50% of consumers are

willing to pay a premium to transact with companies they trust. The reverse is

equally true: About the same percentage (57%) will stop doing business with a

company they believe has broken their trust by using personal data

irresponsibly, and over a third (37%) said they would take legal action against

the company. Considering the trillions of dollars at risk, we now see ethical

behavior as the new theater for commercial competition.

These

are among the key findings from our latest research report “The Business Value

of Trust,” in which we asked consumers in the Asia-Pacific and Middle East

about the relationship between trust and doing business in the digital world.1 We believe our findings are relevant

not only to companies operating in those geographies but also for any

organization concerned with maintaining trust in the digital business world.

The

digital technologies that pervade our existence are transforming how we live,

work and play. Nearly half of consumers we surveyed said they are always

connected, and more than three-quarters (77%) view social media platforms as

critical to maintaining social relationships. At the heart of these changes is

the data we generate with every digital touch, forming our own personal Code

Halo™.2 However, the scale and speed of these

changes present a major challenge.

The

appropriate use of personal data has become a critical factor in how companies

compete, which has raised important ethical considerations: Is it appropriate

for a health insurance provider to monitor its clients’ Apple Watch data and

adjust their insurance premium as a result? How about a pay-per-view movie

provider charging higher rates to customers living in wealthy neighborhoods

than residents of less affluent areas? These are the types of difficult

questions – ethical questions – that companies must grapple with today.

Business

people have always had to consider ethical issues, but in these unforgiving

times, getting data ethics wrong has greater consequences than ever before.

While 90% of consumers have concerns about privacy, hacking, loss of control,

intrusion, piracy and scamming, few swear off the Internet as a result.

Consumers don’t draw a strong line between privacy and security – for them it’s

all about trust. Trust is not limited to just privacy, security or technology

issues but is the new consumer-provider pact that will increasingly drive

business success.

Trust:

The New Brand

As

companies embark on their digital transformation journey, they will be dealing

with questions of how to build and maintain trust, protect individuals’ privacy

and conduct themselves ethically. The value of trust is now a personal matter,

driven by the endless array of consumer data shared with companies across the

business spectrum.

The

age of data sharing (and over-sharing) has raised consumer expectations exponentially,

as 58% of those surveyed said they demand personalized products and services

from companies in exchange for the data they share. We call this the

“give-to-get” ratio, and managing this trade-off transparently is essential for

trust. Companies that earn the highest trust are those that clearly define how

they will use the information they collect, give consumers full control of

their personal data, and offer fair value in return.

At

Volvo, for example, where consumer trust is deeply embedded in the company’s

DNA and is an intrinsic part of the brand, the automaker collects data around

vehicle capability and services, as well as driver data, to ensure customer

safety. Part of the company’s mission statement is that by 2020, no one should

be harmed or killed in a Volvo.3

Companies

that knowingly misinform or mislead consumers in any way about how their

personal data is used increasingly risk self-extinction. Broken trust not only

has a monetary impact on companies, but it can also undermine brand reputation

and damage employee morale, which is often difficult to measure and remediate.

A Forbes Insights report reveals that 46% of organizations surveyed had

suffered damage to their reputations and brand value as a result of a data

breach.4

Facing

a Multi-Trillion-Dollar Meltdown

Trust

is central to many companies’ value proposition. Roughly 43% of consumers we

studied reported having a high level of trust in institutions across

industries; however, 38% plan to switch to the competition or a digital startup

due to trust issues. Furthermore, 70% told us they are likely to take a digital

approach to conducting business with the new provider. Consider these findings:

- Consumers

trust their banks and utilities relatively more than other companies but

are still likely to switch in the event of an unforeseen incident.

Although respondents revealed moderate trust for banks (58%) and utility

companies (50%), they are still likely to switch their bank (32%) and

utility provider (31%) if trust is compromised. The 2008 financial crash

caused many consumers to lose trust in weakened financial institutions.5

- Trust in

government is gradually evaporating, with only half of respondents

expressing trust in government institutions.

Phone-tapping, e-mail snooping and the push to get tech companies to

disclose consumer data has forced many people to rethink how they engage

with local, state and federal institutions.

- Automotive

companies and retailers are at the highest risk of losing their brand

value. Of all industries, consumers

report the lowest level of trust in automotive companies (36%) and

retailers (37%). In fact, 41% told us they would no longer work with

retailers that broke their trust in terms of managing their personal

information. The Volkswagen emissions scandal demonstrated just how

quickly a company can lose consumer trust. The company’s stock lost 20% of

its value, around US$28 billion,6 following revelations that the

company misrepresented emissions measured and reported in its

diesel-powered vehicles. Volkswagen now plans to reduce investment by

US$1.14 billion a year to offset the financial damage it has suffered.7

Interestingly,

digital startups are gradually gaining ground in the battle for consumer trust.

Approximately 47% of respondents told us they plan to switch to a digital

startup due to perceived trust concerns over how their personal data is being

used, compared with 41% who said they would rely more heavily on established,

pre-digital outfits. In fact, 52% of consumers said they are willing to

consider new products and services from non-traditional channels or digital

startups. It appears that traditional businesses struggle as much to meet the

expectations of digitally empowered consumers as to match the energy and

innovation emanating from digital startups.

Transparency

Is the New Currency

The

lack of confidence surrounding privacy, security and trust represents a

tremendous opportunity for companies that are transparent about their use of

the data. Transparency is the top factor (67%) in determining trust in a

company, our respondents said; in fact, 45% said they are willing to share

their personal data if a company asks upfront for the data and clearly states

its use.

When

consumers know that a company shares the responsibility and concern for

minimizing risk, they are more open and willing to trust the company. The

transparency factor has helped digital native companies, such as Facebook,

Whatsapp and Pinterest, create loyal followings in a remarkably short time

period. The basis of collaborative consumption – the sharing economy – is built

on transparency.

Show

Me that You Know Me

To

succeed in today’s digital age, companies must shift from a data-collection

mindset to a consumer-oriented, value-first approach. As consumers become

increasingly savvy about how companies use their personal information, they

demand tangible and immediate benefits in return – assuming, that is, that

companies keep their personal information private and secure.

About

66% of respondents view their personal information as valuable, and 65% are

willing to share it with companies in exchange for some form of value. This can

even be a simple recognition of who they are as an individual rather than as a

number in a customer relationship management system. Interestingly, another

motivator for consumers to share their personal data is better customer

service, reported by almost 80% of respondents. Not surprisingly, the

information that consumers are least willing to share is their banking and

other financial information (17%).

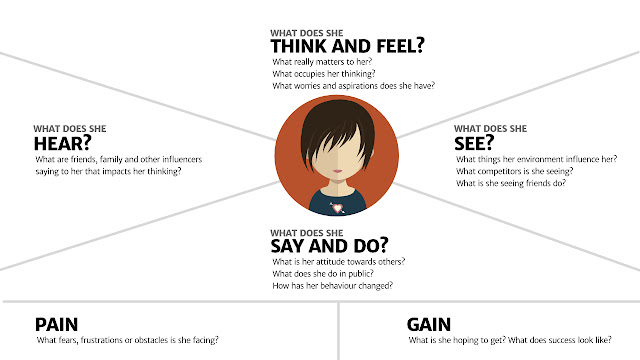

Negative

feedback from family and friends will weaken consumers’ trust; in fact, 65% of

respondents called this a top factor for not sharing their personal data.

Roughly 63% and 61%, respectively, told us that unethical business practices

and a lack of transparency stop them from sharing data with companies. Some

companies have done extremely well in making the trade-off worthwhile. For

instance, Disney uses profiling data through its MagicBand™ bracelet to enhance

the customer experience, and customers are willing to share their profiling and

location data to gain convenience and a sense of privilege at Disney

entertainment venues.8

Act

Now to Thrive in the Trust Economy

The

biggest threat to companies today comes not from the competition but rather

their own ability to win and keep consumer trust. The increasing importance of

data has changed not only how companies deliver products and services but also

how consumers make decisions. To build trust at every touchpoint throughout the

customer journey, senior executives need to make sure their companies have the

right leadership, culture, organizational design, operating model, skills, technology

and processes. To win the value of trust in the new digital world, we recommend

the following:

- Ensure

“gives” and “gets.” Where there are manageable

“gives” and positive “gets” for consumers, sharing information is a

no-brainer. However, if the “get” factor is wrongly imposed (e.g., asking

consumers to accept terms without explaining the ramifications), trust can

be instantly and badly damaged. Therefore, clear and open communication

regarding give-to-get trade-offs are the foundation for creating the

needed transparency that makes it worthwhile for both the company and its

customers.

- Give

customers a delete button. Customers

should have a complete 360-degree view of their information and full

control over it. A good example is the Metadistretti e-monitor, which

provides cardiac patients with control over how much data goes to whom,

using a browser and an app.9 Patients can set up networks of

healthcare providers, family members, friends, fellow users and patients,

and share their desired data with each.

- Be quick

to respond to failures. In spite of the

world-class technology infrastructure in place, history shows that

organizations can’t promise customers that nothing bad will happen to

their digital information. Winning organizations need to recognize,

understand and proactively manage potential issues. For instance, after a

recent cyber-attack, Vodafone was quick to notify customers and banks of

the incident, which helped maintain consumer trust and confidence.10

This

article is adapted from The Business Value of Trust, a report from the

Cognizant Center for the Future of Work on how trust is reshaping business

models across industries. It fully explores the ethical battlefield of digital

business across a range of industries, and highlights the factors that

determine how consumers think about trust, the economic value associated with

it, the risks inherent in a “give-to-get” formula and recommendations on how to

succeed in this new landscape. To learn more, please visit http://www.futureofwork.com/.

Note:

For more on the give-to-get equation, read our book Code Halos: How

the Digital Lives of People, Things, and Organizations are Changing the Rules

of Business, by Malcolm Frank, Paul Roehrig and Ben

Pring, published by John Wiley & Sons. April 2014 http://www.wiley.com/WileyCDA/WileyTitle/productCd-1118862074.html.

Code

Halo™ is a trademark of Cognizant Technology Solutions.

Footnotes

1 Cognizant’s Center for the Future

of Work surveyed 2,404 consumers in APAC and the Middle East in late 2015 and

early 2016. Full results of the study will be presented in our upcoming report

“Digital Consumer Trust 2.0.”

3 Jack Hershman, “Volvo Group CIO:

Data and Trust as Currency in the Digital Age,” Hot Topics, https://www.hottopics.ht/stories/consumer/volvo-groinup-cio-data-and-trust-in-the-digital-age/.

4 Doug Drinkwater, “Does a Data

Breach Really Affect Your Firm’s Reputation?” CSO, Jan. 7, 2016, http://www.csoonline.com/article/3019283/data-breach/does-a-data-breach-really-affect-your-firm-s-reputation.html.

5 Jeff John Roberts, “Twitter’s

Transparency Report Is Scary, But Not Always Helpful,” Fortune, Aug. 12,

2015, http://fortune.com/2015/08/12/transparency-reports/.

6 Ivana Kottasova, “Volkswagen

Stock Crashes 20% on Emissions Cheating Scandal,” CNN Money, Sept. 22, 2015, http://money.cnn.com/2015/09/21/investing/vw-emissions-cheating-shares/.

7 David Amerland, “The Cost of

Losing Trust,” Medium.com, Oct. 15, 2015, https://medium.com/@davidamerland/the-cost-of-losing-trust-97d764a1e696#.n0sclvwsa.

8 Timothy Morey, Theodore Forbath, Allison Schoop,

“Customer Data: Designing for Transparency and Trust,” Harvard Business

Review, May 2015, https://hbr.org/2015/05/customer-data-designing-for-transparency-and-trust.

10 Dateme Tamuno, “Trust in the

Digital Age: How Far Is Too Far?” Customer Think, Nov. 3, 2015, http://customerthink.com/trust-in-the-digital-age-how-far-is-too-far-a-vodafone-and-talktalk-case-study/.

Author

Manish

Bahl is a Cognizant Senior Director who leads the company’s Center for the

Future of Work in Asia-Pacific. A respected speaker and thinker, Manie has guided

many Fortune 500 companies into the future of their business with his

thought-provoking research and advisory skills. Within Cognizant’s Center for

the Future of Work, he helps ensure that the unit’s original research and

analysis jibes with emerging business-technology trends and dynamics in Asia,

and collaborates with a wide range of leading thinkers to understand how the

future of work will take shape. He most recently served as Vice-President,

Country Manager, with Forrester Research in India. He can be reached at Manish.Bahl@cognizant.com

| LinkedIn: https://in.linkedin.com/in/manishbahl |

Twitter: @mbahl.

Comments

Post a Comment